A brief guide to paying VAT & duty, the UK trade tariff and using incoterms

With the UK-EU trade deal finally agreed, once we have left the EU, there continues to be a massive challenge with the negotiation of more than 750 treaties across 168 countries. As a result the distinction between how exports are handled now the UK is outside the EU have undergone significant changes.

Read the latest advice on preparing to export goods from the UK to the EU from January 1 2021

One key fact to note is that the Government will automatically enrol companies with the customs identification they need, to keep trading with the EU and HMRC will allocate more than 88,000 firms with an Economic Operator Registration and Identification (EORI) number. These unique identifiers are needed to track companies trading with the EU and collect duties, however non-VAT registered companies will still need to apply manually.

Goods & services to EU & non-EU countries

Exports to EU & non-EU countries require you to submit an export declaration. In addition, you may need an export licence and have to pay custom duties and taxes in the destination country - see our quick guide to the do's & don'ts of applying for export licences.

Economic Operator Registration and Identification EORI number numbers are required, when trading outside the EU. Your unique number can be obtained alongside VAT registration and will be needed whenever you are dealing with customs. Find out more about applying for an EORI number and what is involved. You will need to register on the CHIEF system and submit your declaration through the NES.

What is the New Export System (NES)?

HMRC’s New Export System is used to register, create & submit online export declarations, which should include details about the type of goods and their destination.

Special rules will apply for “indirect exports”, when you move goods via other EU countries before exporting them to a third country. For these you may also need a trade control licence if moving strategically controlled goods (e.g. military or defence) between two non-EU countries and a transshipment licence if you arrange the shipment of goods through the UK.

Paying VAT (on exports to EU & non-EU countries)

For services you don’t charge VAT and you can zero-rate most goods, but you must get evidence that the goods have left the UK within three months of the sale. You should also keep a record of the export in your VAT account, although you will need more detailed records if your customer collects the goods from you.

Paying duty (on exports to EU & non-EU countries)

Duty charges are set by the country you export to and will depend on the type of goods, where they come from and their value. However you may be able to claim duty relief as there are currently trade agreements with some countries and the EU, that allow you to export at lower or zero duty rates. In these cases you must usually be able to prove where the goods originally come from.

What is the UK trade tariff?

The UK Trade Tariff is based on the EU's TARIC database (including additional UK-specific measures). The tariff allows you to look online for the commodity codes of the goods you export and import. These codes are used to classify your goods for duty, tax rates and regulations, e.g. licences.

The tariff provides the most accurate information at any given time receiving daily updates direct from TARIC. Because duty rates and other customs measures are frequently changed or updated, it is important to keep up to date with any changes relating to your product(s).

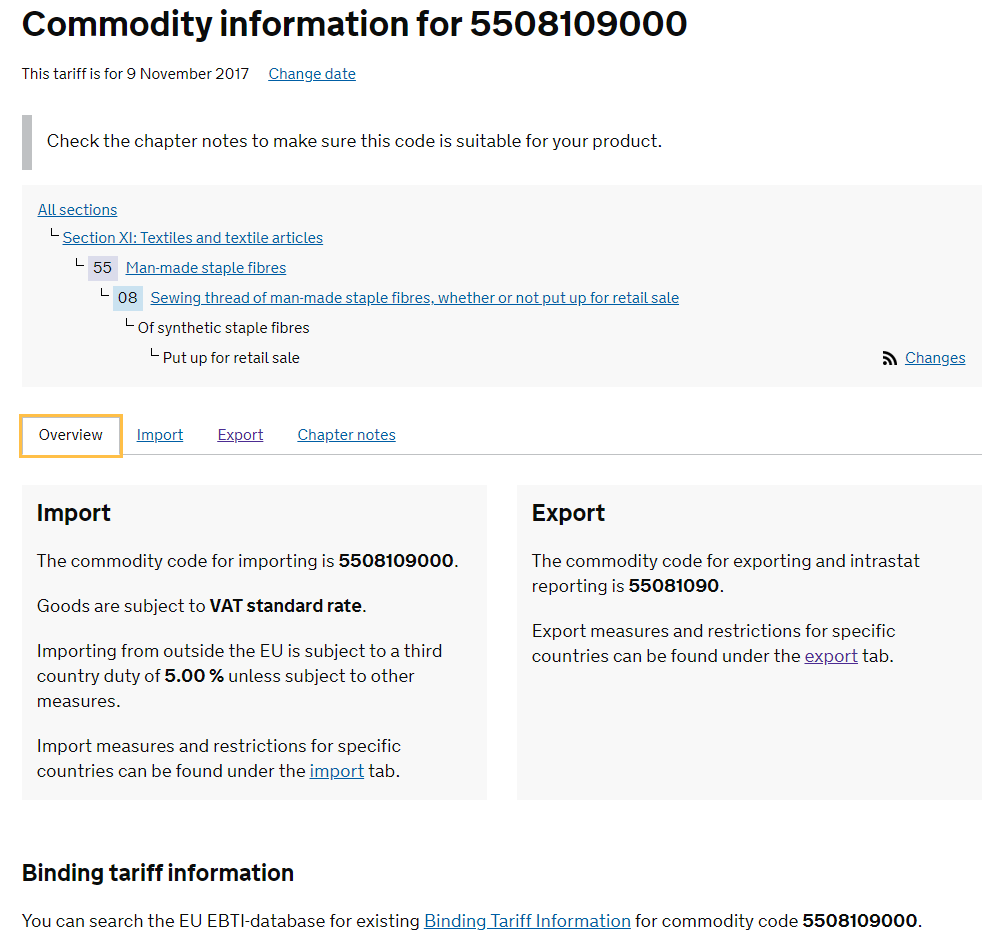

Here is an example of the typical search results you see when searching for a commodity code:

The Trade Tariff will be an important place of reference post-Brexit, depending on the trade deals the UK manages to negotiate - whether they follow deals similar to Canada, which eliminate most tariffs/trade barriers or deals based on WTO terms.

Why are incoterms important?

Because many countries have different business cultures as well as languages, it is essential to ensure there is a clearly written international trade contract between the buyer and seller, in order to minimise financial risk and any misunderstandings.

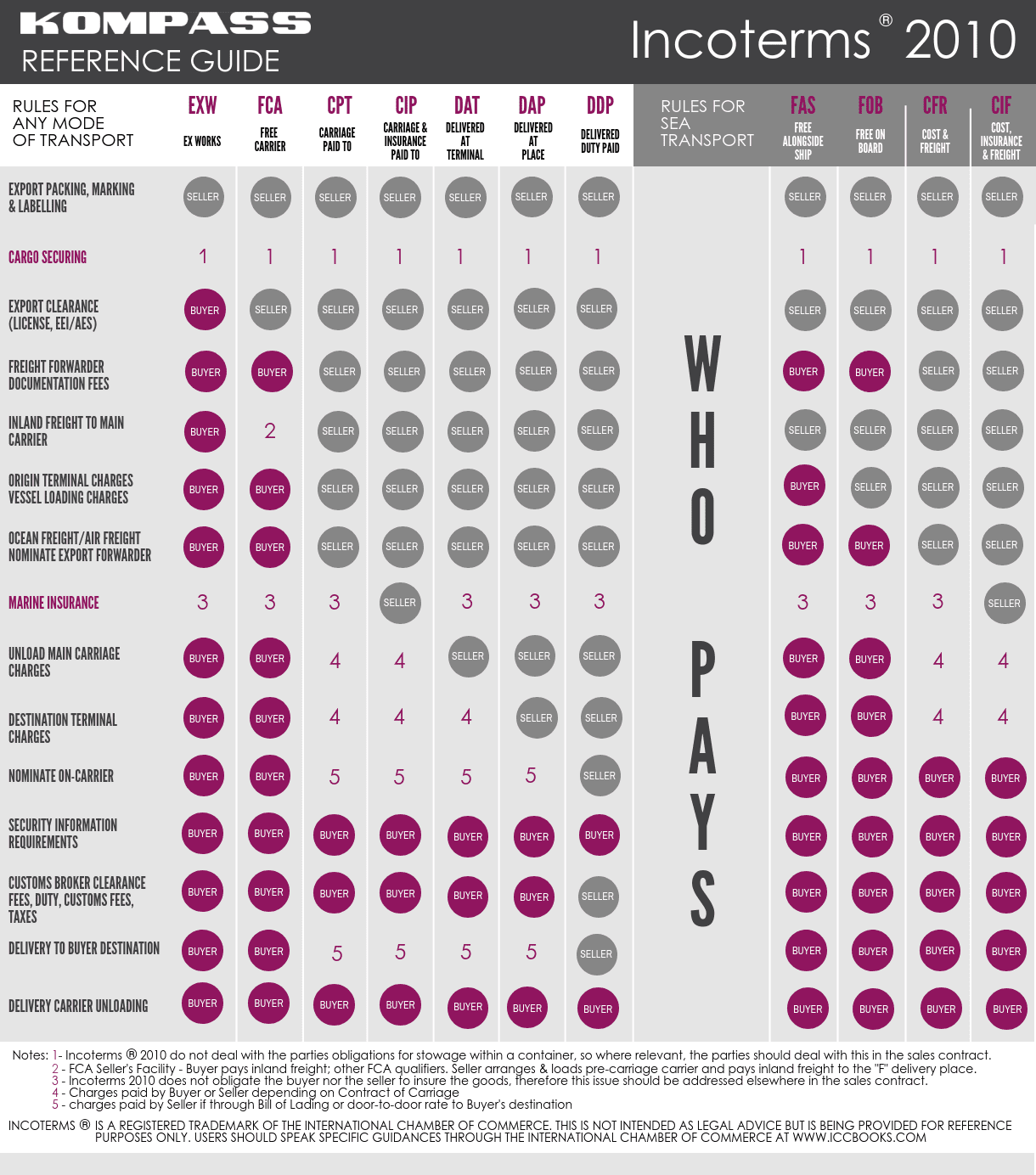

The Incoterms ® 2010 rules were created and are updated by the International Chamber of Commerce (ICC) as a standard set of trading terms and conditions, designed to assist traders when goods are sold and transported. Each rule specifies the obligations of buyers & sellers, defining where risk, during the journey, transfers from each party.

Agreeing to & incorporating an incoterms rule into an international trade contract, means that both parties clearly understand what is expected of them and where responsibility lies in the event of any mishap. The rules will outline the exact delivery terms being agreed to such as:

- where goods will be delivered

- who arranges transport

- who pays and is is responsible for insuring the goods

- who pays any duties and taxes and handles customs procedures

They should cover who is responsible for every stage of the journey, including customs clearance and make clear who pays for each different cost. In addition the contract should outline all aspects of payment, including which currency payment will be made, how much will be paid, when payment is due and the payment method that will be used.

Remember, with no physical delivery of the product, trade contracts relating to services cannot use Incoterms. Therefore the key factor to consider with this sort of contract is likely to be defining exactly what services are being provided and the standards that are expected.

One key aspect to using Incoterms is to make sure they are fully understood & used correctly, because this too can cause problems if they are misused.

All you need to know about exporting goods outside the EU

Get Help & Advice from the Experts!

To summarise, when trading overseas, it is imperative that you make sure your company complies with the relevant legislation, so it goes without saying that you should always seek expert guidance from the relevant authorities. This will be especially important in the light of Brexit and the impact this has had on both European and global trading markets for UK exporters.

– Use Kompass Business Data to research and find contacts in your target markets.

– Department for International Trade Advisers should be considered key contacts for help and advice.

– Your Local Chamber of Commerce can help with export documentation and finance.

– UK Export Finance provides trade finance and insurance for exporting.

– B2BCentral works with partners to bring the benefits of B2B eCommerce to British SMEs.

– The Institute of Export gives advice, guidance, offers courses and qualifications.

– Find new export markets with a personalised Market Ranking Report from Kompass.

– Build your brand & global online presence with Kompass Digital Marketing solutions.

At Kompass we have more than 60 years experience, helping businesses grow – providing our customers with business data to help improve the results of their sales and marketing activity and driving relevant enquiries through globally optimised company profiles from more than 7.5M Kompass users. Contact us to find out more about how we can help you as you plan your export strategy.

Our Kompass Export Zone builds on our business information expertise, by giving access to straightforward guidance on some of the key factors to consider when exporting, research advice and country specific market information. For more advice on getting started on your export journey, see How legislation affects overseas trade for UK companies.

Disclaimer: Please note that this blog only contains general information and insights about legal matters. The information is not advice, and should not be treated as such. Kompass.com